Search The IIP Blogs:

Navigating The Advice Process

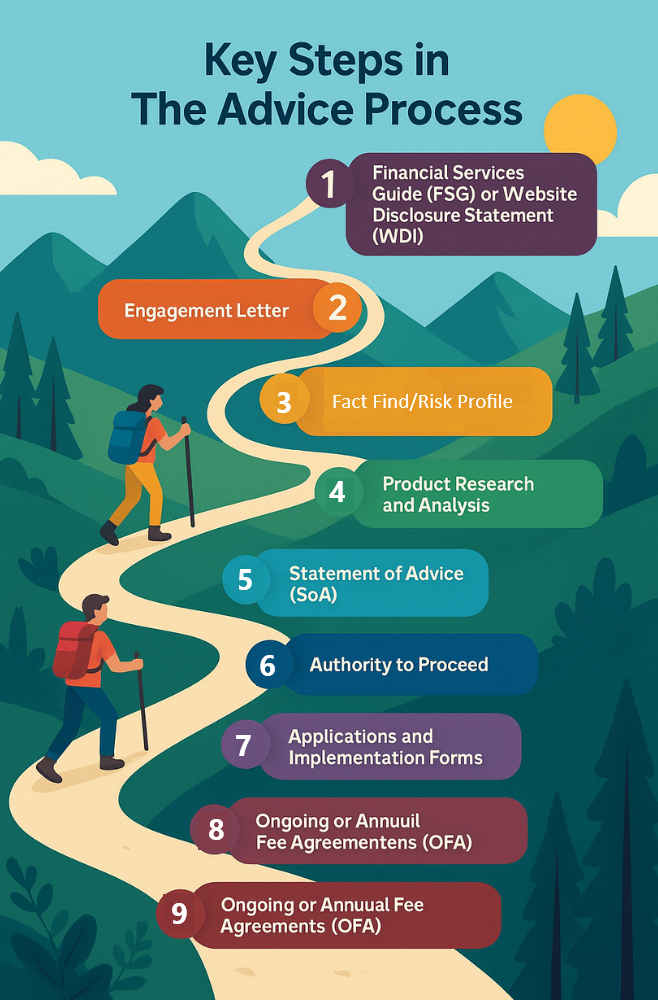

Understanding the Financial Advice Process in Australia: A Step-by-Step Guide

Informed Consent For Insurance

Informed Insurance Consent - What Are Your Obligations under the new legislation?

Monitoring and Supervision Framework

Financial advice is only as good as the governance behind it. That is why Insight Investment Partners has released two companion documents—our Monitoring and Supervision Policy and the Compliance File Review Policy & Procedure

Preparing For Your File Review

Got an email about your file review? Follow this guide to prepare for your compliance file review

Sara’s Investment Portfolio Checks—Upcoming Updates

We are excited to announce an upcoming update to Sara’s Risk Profile checks when reviewing your clients’ recommended investment portfolios.

Leveraging AI in Financial Services: The Responsible Approach

Artificial Intelligence (AI) is transforming industries worldwide, and financial services are no exception. At Insight Investment Partners (IIP), we recognize the potential of AI to enhance efficiency, improve client engagement, and drive business growth. However, with great power comes great responsibility

SARA Now Checks for Consent Forms

SARA now checks that your Statement of Advice (SOA) includes a Fee Consent Form when charging ongoing advice fees or establishing a fixed-term agreement from a superannuation account. This enhancement ensures compliance and helps streamline your advice processes.

Website Disclosure Information

In this episode, SARA discusses your obligations when relying on Website Disclosure Information

Changes to Ongoing Fee Arrangements

As part of the Delivering Better Financial Outcomes (DBFO Package, the Albanese government has made amendments to the obligations relating to ongoing fee arrangements and consents.

Changes To Conflicted Remuneration

Changes to Conflicted Remuneration means that if a retail client’s payment (or other benefit) to you is a payment (or other benefit) given in relation to a financial product or a financial service, it is now definitely not conflicted remuneration.

Transitioning from Financial Services Guides to Website Disclosure Information

Advisers no longer need to provide a Financial Services Guide (FSG) to every single client. Instead, they can now make this information available as Website Disclosure Information on their website. This change offers a great opportunity to simplify the administrative side of financial advice and modernise how we engage with clients.

Standard 3 (FASEA Code of Ethics) & Referral Fees: What’s the Actual Story?

Financial advisers often face questions about how to navigate ethical obligations while remaining compliant with regulations. A key issue frequently raised is the relationship between referral fees and conflicts of interest.

Financial Advisers: Essential Guide to Privacy Policies in Australia

Recently, we were asked by an advisor about meeting their obligations under the Australian Privacy Principles (APPs).

As a financial adviser in Australia, ensuring the privacy of your clients' personal information is paramount.

Update On Tranche 1 Of The DBFO

The DBFO Act, which received royal assent on 9 July 2024, represents Government’s response to QAR final report recommendations 7, 8, 10, 13.1–13.5 and 13.7–13.9. It is the first tranche (‘Tranche 1’) of Government legislation as part of the DBFO package.

Compensation Scheme of Last Resort

ASIC has issued the levy notices for the Compensation Scheme of Last Resort (CSLR).

Breach Reporting

At the recent the Professional Planner Licensee Summit, ASIC Commissioner Alan Kirkland outlined that the regulator has been warning all licensees for the past two years that they must lift their game in respect to breach reporting

When Can I Give Further Advice (ROA’s)?

This article will address some of the issues to consider and how to go about approaching the SOA vs ROA conundrum.

Financial Services and Credit Panel – Some Interesting Stats

There have been 16 outcomes issued by the Financial Services and Credit Panel (FSCP) since its launch in 2023. Here are some statistics on which issues are frequently occurring:

Internal Dispute Resolutions (Complaints)

Under recent legislative changes, as an Australian financial services (AFS) licensee, who provide financial services to retail clients, we are required to report to ASIC any consumer and small business complaints under the internal dispute resolution (IDR) procedures.

So, what does that mean?