Changes to Ongoing Fee Arrangements

As part of the Delivering Better Financial Outcomes (DBFO) Package, the Albanese government has made amendments to the obligations relating to ongoing fee arrangements and consents. These amendments apply ongoing fee arrangements:

entered into on or after 10 January 2025 (start day), and

already in force on the start day, from the first anniversary of the arrangement that occurs after the start day.

Say Goodbye to FDS

Under the DBFO Act reforms, you no longer need to send your client a Fee Disclosure Statement. These obligations have been replaced with new consent requirements relating to entering into an OFA and paying fees.

When entering into an ongoing agreement, there are two consent forms you need to obtain from your client.

OFA Consent

When entering into an ongoing agreement, there are two consent forms you need to obtain from your client.

Firstly, you will need to obtain a signed consent to enter into an ongoing agreement. This is called OFA Consent, and is similar to the existing Ongoing Fee Agreement which outlines the services to be provided and fee payable.

Fee Deduction Consent

Secondly, you will need to obtain a signed fee deduction form, which gives the third party product provider a consent to deduct the fee from the clients super or investment account.

Ongoing Fee Agreements

For the OFA to be effective, you must disclose to the client, in writing:

the name and contact details of the person who is the fee recipient under the OFA;

an explanation of why the fee recipient is seeking the consent;

the maximum period until the consent will cease to have effect;

information about the services the client will be entitled to receive under the arrangement during that period;

for each ongoing fee that the client will be required to pay under the arrangement during that period:

the amount of the fee; or

if the amount of the fee cannot be determined at the time of disclosure, a reasonable estimate of the amount of the ongoing fee and an explanation of the method used to work out the estimate;

the frequency of the ongoing fees during that period;

a statement that the OFA can be terminated at any time;

a statement that the arrangement will terminate, and no further advice will be provided or fee charged under it, if the consent is not given; and

the date on which the arrangement will terminate if the consent is not given.

Your client can also sign the written consent electronically by, for example:

clicking a check box on a webpage in response to a statement such as: ‘By ticking the box, you consent to renewing the ongoing fee arrangement and to the charging of the ongoing fees that are set out in this document’, or

sending you their written consent by email with their electronic signature attached.

Consent and Renewal Timelines

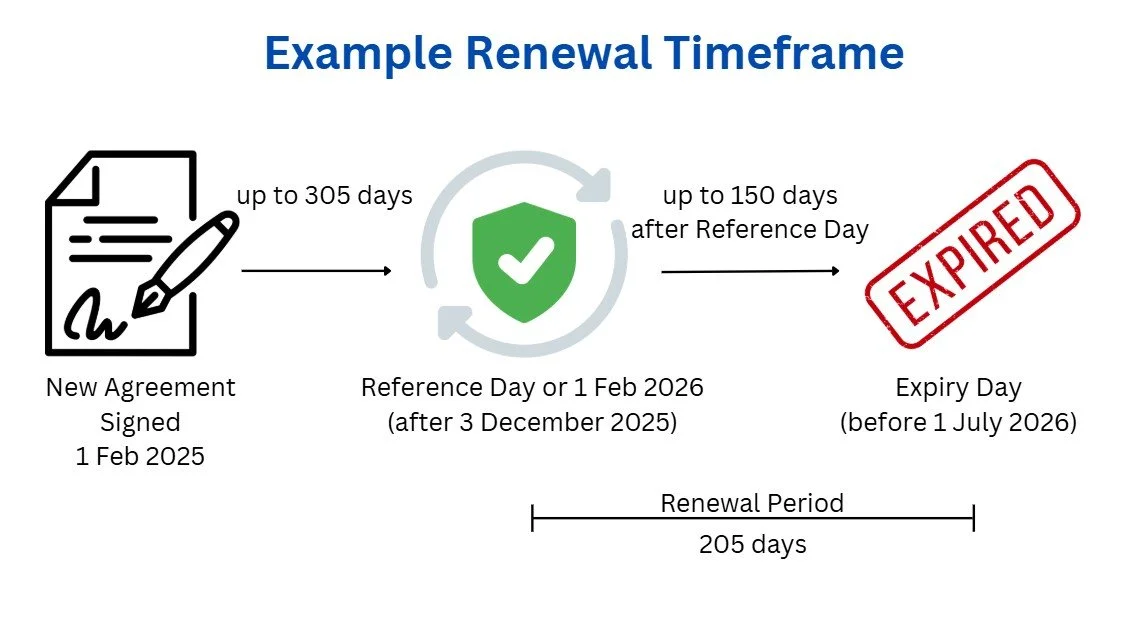

At the time an ongoing fee arrangement is first entered into or renewed, clients and fee recipients may agree on a day (known as the ‘reference day’) which is used to determine the timeframe in which fee recipients can obtain written consent to renew an ongoing fee arrangement from their clients: see section 962H. The timeframe commences 60 days before the reference day and ends 150 days after the reference day.

For a reference day to have effect, it must be a day that is earlier than the anniversary of the day that the ongoing fee arrangement was entered into, and it must be disclosed to the client before they provide consent.

If a reference day is agreed on, its anniversary will be relied on to determine the timeframe in which a written consent can be signed going forward, unless the client and fee recipient subsequently agree on a different reference day.

This means that each year, a written consent that meets the requirements must be signed in the timeframe that starts 60 days before and ends 150 days after:

the agreed reference day, or

if no reference day has been agreed on, the anniversary of:

the most recent reference day specified in a consent, or

if no reference day has ever been specified, the anniversary of the day on which the arrangement was entered into.

The reference day should be relied on to determine the period in which the client is entitled to services under the ongoing fee arrangement and the period in which ongoing fees are to be paid. If the client and fee recipient agree on a different reference day, the services that the client is entitled to receive under the arrangement should be provided by that day.

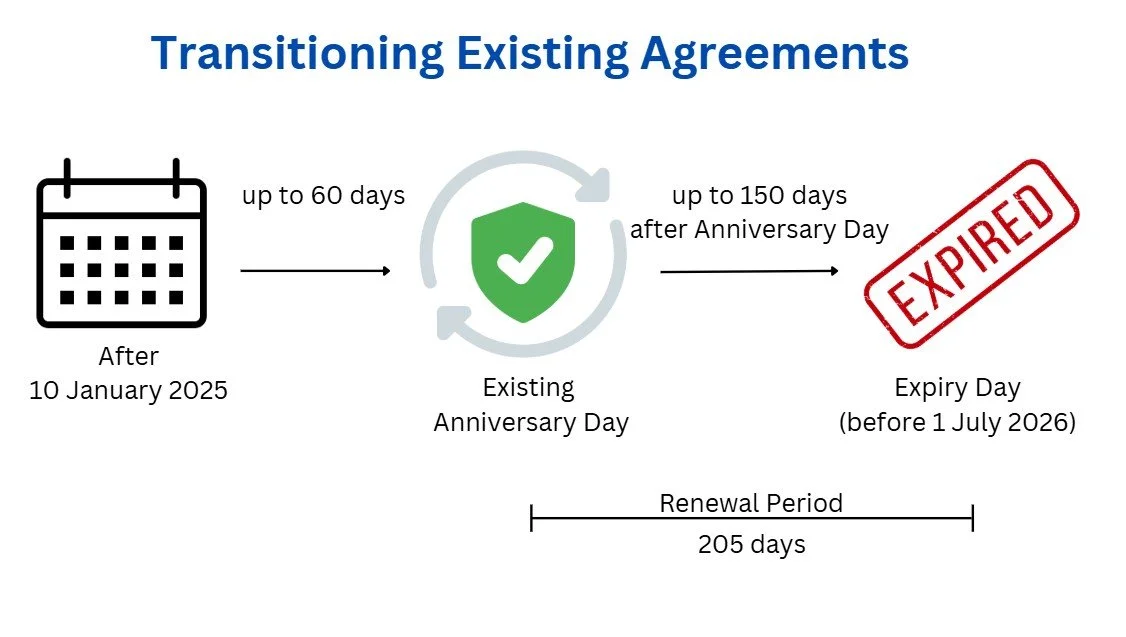

All the new requirements will apply to an existing OFA from the anniversary of the day it was entered into – that is, what is known as the ‘anniversary day’ under the existing regime. But we are talking about the first anniversary day that occurs after 10 January 2025. This is known as the ‘transition day’. But the requirements are modified slightly for these existing OFAs, as set out below.

Where an existing OFA has an anniversary day prior to 10 January 2025, the current FDS and renewal requirements continue to apply in relation to that OFA, even though these will, in some cases, be met by you providing the FDS and obtaining consent to renewal after 10 January 2025. This might occur for example, where an OFA has an anniversary day in December.

Consent for renewal and ongoing fees that meets the new requirements must be obtained from the client in the period starting on the later of 10 January 2025 and 60 days before the anniversary of the day the OFA was entered into and ending 150 days after the anniversary of the day the OFA was entered into. Consider the first anniversary day that falls after 10 January 2025 as being the reference date for these OFAs.

For subsequent OFA Consents and Fee Deduction Consents, you can set a new reference date and, if you don’t, the anniversary of the date the OFA was entered into will be the reference date.

Ongoing Fee Agreements and Consent Templates

We will be updating our policies and procedures to reflect these changes.

We will also be releasing updated Ongoing Fee Agreements and Consent Form templates for the Xplan wizards.

For more information on changes to ongoing fee arrangement obligations you can refer to the ASIC Guidance and the HN Law articles on the links below