Financial Services and Credit Panel – Some Interesting Stats

There have been 16 outcomes issued by the Financial Services and Credit Panel (FSCP) since its launch in 2023. Here are some statistics on which issues are frequently occurring:

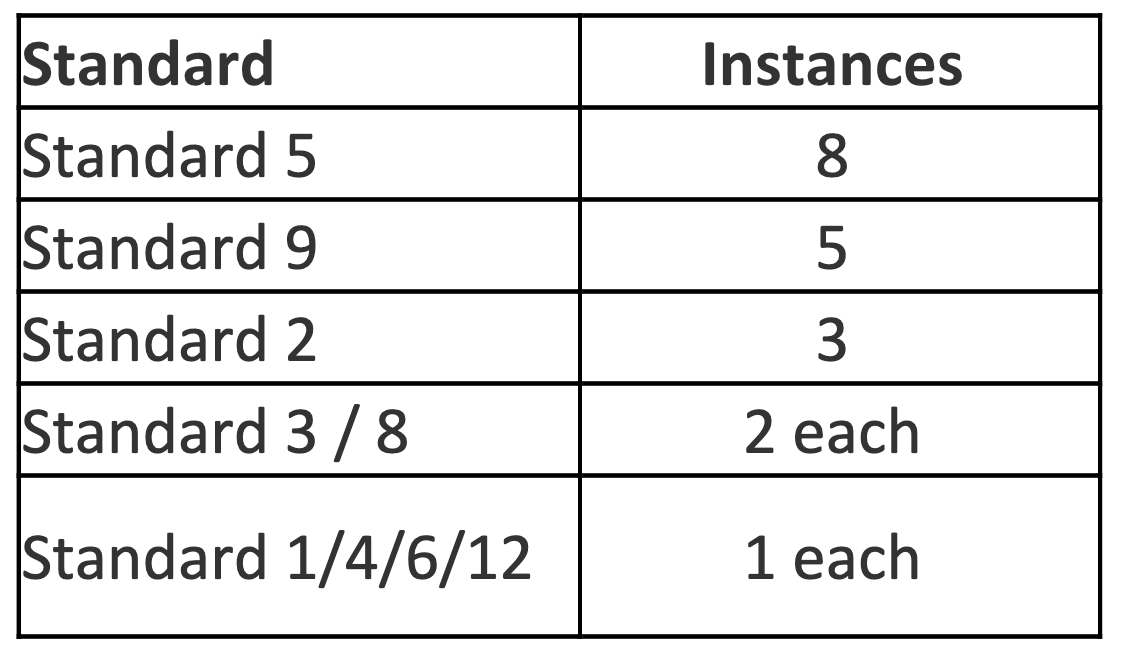

The most common topics:

50% of issues involve the Statement of Advice. Although in some of these cases, the issues were that the adviser did not provide a Statement of Advice, or did not include the relevant advice in the Statement of Advice (i.e an SOA was given, but it didn’t include the advice of making downsizer contributions).

Code of Ethics standards breached

The most common Code of Ethics breaches relate to Standard 5. These state advisers must ensure that all advice and products are in the best interest of each client, appropriate to the individual circumstances of each client, and presented in terms easily understood by the client.

The second-most common – Standard 9 – states advisers must ensure all advice and products are offered in good faith and with competence and are based on information that is neither misleading nor deceptive.

Products, Products, Products

Still, now, advice on products (specifically switching products) is the most common area for breaches.

As a general rule, making recommendations around strategic advice that don’t involve product – i.e. contributions, cashflow, paying down debt, updating wills, starting pensions, etc.- are low-risk advice areas. Advising a client to maintain their current super or investment product will also be low-risk advice.

Let’s Talk Switching

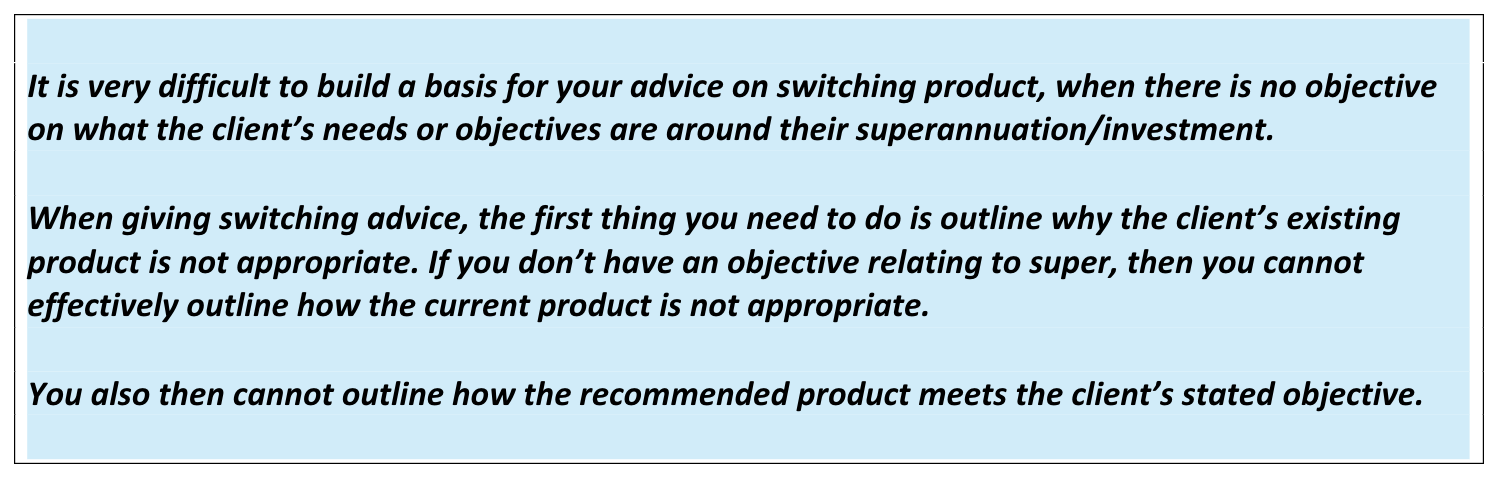

When switching products, I always find one common mistake when it comes to deficient product switching: No related objective.

Is Cost Everything?

Interestingly, on the 26/02/2024 The Sitting Panel has decided not to take any action against the relevant provider (Mr B). The relevant provider gave advice in a Statement of Advice (SOA) to a couple recommending that they roll over their superannuation funds from their existing fund to a new product that would cost a total of $1,960 per annum more.

The matter was referred due to concerns that the adviser failed to demonstrate how the more expensive recommended product, which was described in the SOA as having low fees and being cost-effective, would benefit them, and by failing to demonstrate that their existing funds could meet their goal of investing their superannuation in a ‘suitably diversified product that met their investment preferences’.

The concern was that the advice was not appropriate in contravention of s961G of the Corporations Act 2001 and that the relevant provider contravened s921E(3) of the Corporations Act 2001 by failing to comply with the Code of Ethics by failing to demonstrate the value of diligence and not complying with standard 5.

Based on the SOA, the Sitting Panel was not satisfied that the relevant provider had contravened the Corporations Act 2001.

Key Takeouts:

The large majority of cases that end up in front of the FSCP involve a Statement of Advice, more specifically related to products and switching products.

When reviewing advice, switching products will always attract a higher level of scrutiny than making strategic recommendations or maintaining existing products.

When recommending switching products,.

Cost isn’t everything. Although, if you are making a recommendation to switch to a higher cost product, you need to first outline why the existing product is not appropriate, and how the recommended product meets the client’s stated objective.

Avoid using objectives that are too general. In the above example from the FSCP, the stated objective of ‘suitably diversified product that met their investment preferences’ is too generalised and subjective. What is suitably diversified? What are the client’s investment preferences? You would need additional file notes and evidence that clarifies what this means for the client.

You can access the full list of FSCP Outcome Register at https://asic.gov.au/regulatory-resources/financial-services/financial-advice/financial-services-and-credit-panel-fscp/fscp-outcomes-register/