Internal Dispute Resolutions (Complaints)

Under recent legislative changes, as an Australian financial services (AFS) licensee, who provide financial services to retail clients, we are required to report to ASIC any consumer and small business complaints under the internal dispute resolution (IDR) procedures.

So, what does that mean?

If any adviser receives a complaint from their client – whether that complaint is made against an adviser, or a financial product provider, we must notify ASIC of the complaint.

When do we need to report?

We must submit a report to ASIC every six months. The reporting periods are:

1 January to 30 June, and

1 July to 31 December.

We have already commenced reporting to ASIC, with our first reporting period submitted in February 2024.

What is a complaint?

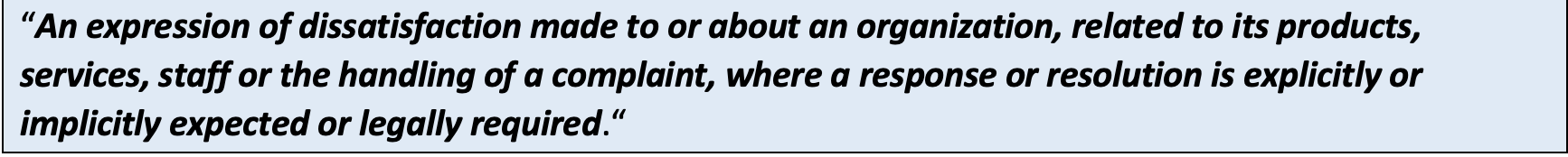

According to RG Guide 271, a complaint is:

A financial firm must deal with expressions of dissatisfaction that satisfy this definition under its Internal Dispute Resolution (IDR) process, which in turn must meet the requirements set out in this guide.

What is our IDR process?

Our IDR process is detailed out in our Complaints Policy.

You can access the latest version of the Complains Policy from the Policy Register in your iC2 Compliance Hub.

A financial firm should acknowledge receipt of each complaint promptly. ASIC expects that firms will acknowledge the complaint within 24 hours.

A financial firm must provide an ‘IDR response’ to a complainant no later than 30 calendar days after receiving the complaint.

An ‘IDR response’ is a written communication from a financial firm to the complainant, informing them of:

(a) the final outcome of their complaint at IDR (either confirmation of actions taken by the firm to fully resolve the complaint or reasons for rejection or partial rejection of the complaint);

(b) their right to take the complaint to AFCA if they are not satisfied with the IDR response; and

(c) the contact details for AFCA (which are also included in the FSG).

How can I notify my compliance manager of a complaint?

ASIC expects us to take a proactive approach to identifying complaints.

You can lodge a complaint with your compliance manager at the iC2 Compliance Hub.

Simply click ‘Add New’, and select ‘Create Complaint’, as shown below:

iC2 will show a popup where you can submit the details of the complaint, and attach a report of the details and any supporting documentation.

Your Compliance Manager will receive a notification of the compliant and will then be able to assess the complaint details and advise the next steps to be taken.